Increase profitability by recovering credit card fees

A recent member survey showed that very few members recover the cost of credit card fees, and some still believe it is illegal in NY. However there has been a recent legal change that enables you to recover credit card fees as long as you do it the right way,

During a recent webinar we learned from our merchant processing partner, TMGvets, that when animal hospitals start charging extra for credit card use they experience very little or no pushback from clients. They either pay the fee or pay another way. If you want to move forward, our merchant processing partner can help you get started.

Watch our May ’25 webinar

This 30 minute webinar features the NYSVMS attorney and our credit card processing partner.

It provides a complete guide for recovering your credit card costs.

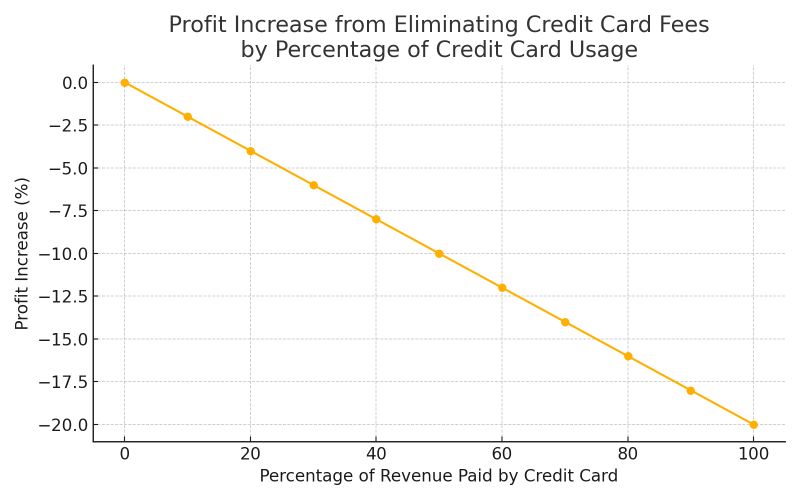

How much you can increase your profit (or reduce costs)

The graph indicates how much your profitability could change depending on how much of your revenue is currently from credit cards. Of course you could also use the benefit to reduce prices for those who don’t use cards.

Webinar Summary: Increasing Your Profitability by Charging for Credit Cards

Legal Overview (by attorney Frank Fanshaw)

- Credit Card Surcharges Are Legal in New York (as of February 2024), if implemented correctly.

- Compliance Requirements:

- The surcharge must not exceed what your credit card processor charges you.

- You must either:

- Display a total price that includes the surcharge, or

- Offer two-tier pricing (one for credit card, one for cash/check).

- You cannot add a line-item surcharge at checkout—it must be part of the stated price.

- Non-compliance Penalties: $500 per violation (per transaction).

Operational Considerations

- Flat-Rate Pricing Recommended: Simplifies compliance and avoids card-specific fees.

- Debit Cards: Cannot be surcharged; systems should automatically exclude them.

- Practice Management Software: Partial integration; surcharges must be processed through the point-of-sale system but recorded appropriately.

How you present the invoice is important

This example illustrates the right and wrong way to present the credit card surchage. Watch our webinar video for more details.